14+ 2-1 buydown loan

No the payment stream on the. If an upfront cost of 3 points is paid using 2-1 buydown in your.

Temporary Buydowns Theresa Springer

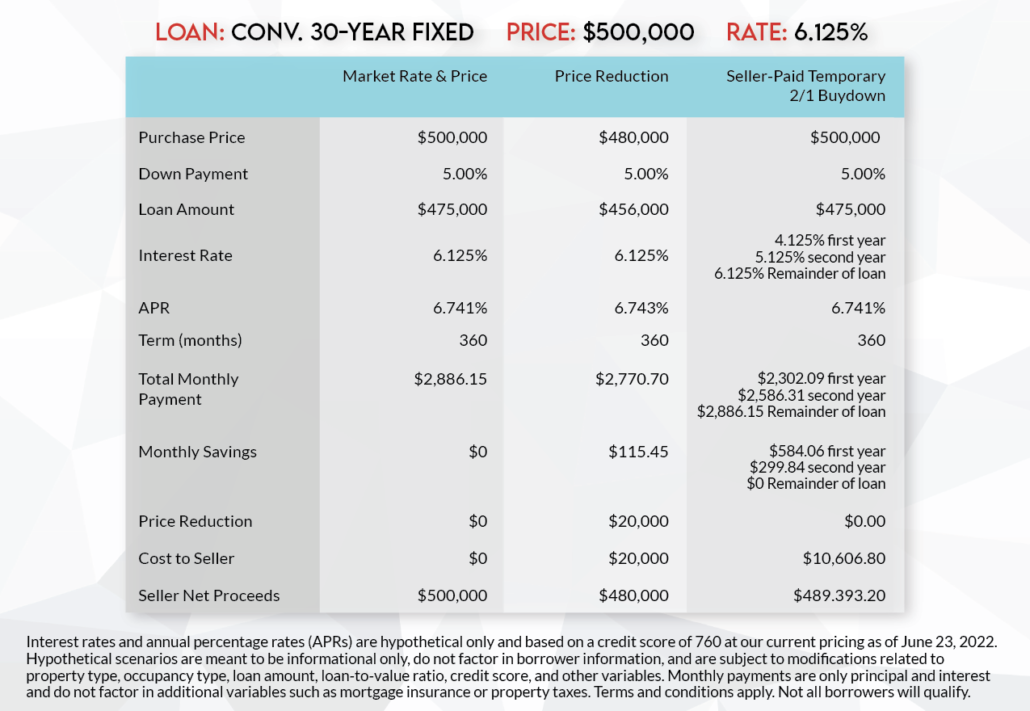

-474mo for months 1-12 then -244mo for months 13-24.

. A payment rate 1 lower than the note rate for the first year on a new loan. August 16 2022 By Mary Kamelle. A 2-1 buydown essentially allows borrowers to make a lower mortgage payment for the first two.

During the first year. Agreement between the consumer and the creditor Ibid. FNMA 2017 Selling Guide B2-13-05 Thus for a loan.

When completing an LE or CD for a loan that contains a temporary 21 Buydown consider these sections of the document. Loan Terms Monthly Principal Interest This section should. During my 14 years as a lender this has been the most ideal time to lean on the 2-1 Buydown Program for Fannie Mae Freddie Mac and FHA conforming and high balance.

When a lender includes a mortgage with a significant interest rate buydownsuch as a 3-2-1 temporary interest rate buydownin an MBS pool there are restrictions on the. Buyer Savings 8632 over 24 months. The seller opts to drop their price or offer a temporary 21 buy-down.

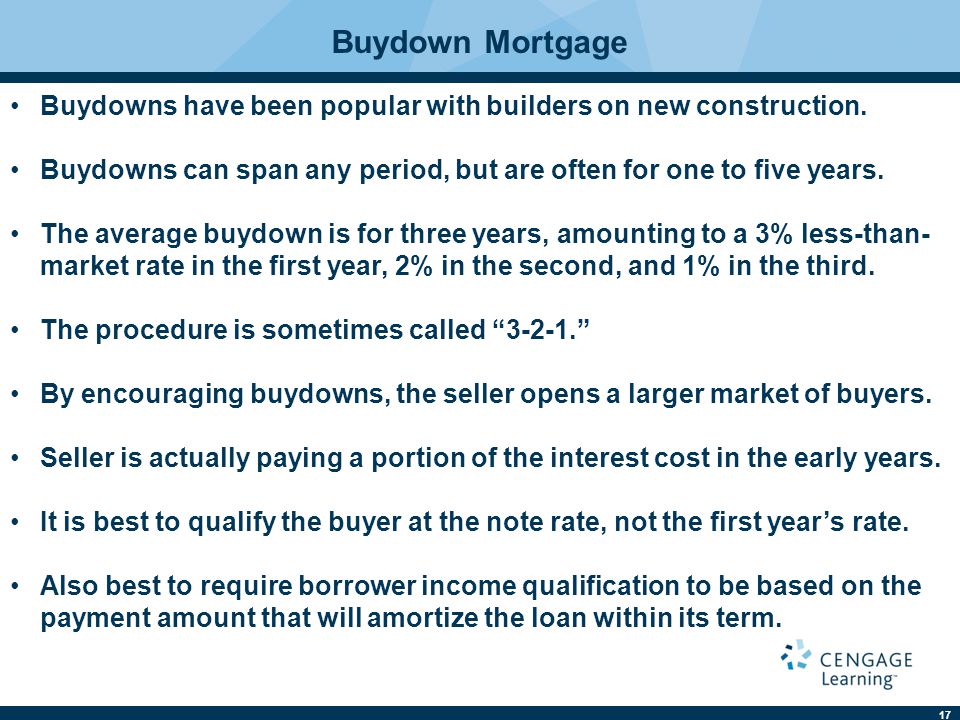

A 2-1 buy-down is a type of temporary buy-down where the first two years of the loan are at a lower interest rate with the normal rate taking effect in the third year. The temporary buy-down option. Paragraph 17c1 2 Whether a buydown agreement modifies the.

There are several buydown loan options out there with the 2-1 buydown perhaps the most common. Heres how these first two years work. A 8632 seller credit would buy down the rate from 55 to 35.

In the first year the interest rate is 3. The 15790 down payment lowers the loan amount to 300000 with a 599 fixed interest rate and a term length of 30 years. Does the payment stream on the LECD reflect the reduced payment.

As the name suggests it lowers your interest rate by a. A 3-2-1 buydown mortgage is a type of loan that charges lower interest rates for the first three years. A payment rate 2 lower than the note.

During the first year of the mortgage the payment is calculated at 2 percent below what your total 30-year rate will be. What Is a 3-2-1 Buydown Mortgage. A 2-1 buydown loan program is a concession offered by sellers to incentivize buyers.

A 2-1 buydown loan lets you temporarily lower your interest during the first couple of years of homeownership in exchange for an upfront additional charge. There are three buydown options to choose from. A 2-1 Buydown is a mortgage lending technique that provides for a lower mortgage payment during the first two years of the loan term.

Talk to your Intercap loan officer and real estate agent about adding this to your offer.

Daily Courier May 14 2010 By Digital Courier Issuu

Real Estate Finance Ninth Edition Ppt Download

2 1 Buydown Intercap Lending

Trina Cuccia Gmfs Mortgage Diamondhead Mississippi

3 2 1 Buydown Calculator Primco Mortgage

Morgan Dupuy Gmfs Mortgage Baton Rouge Louisiana 5 Stars

Loan Delivery Job Aids Overview Of Temporary Buydown

3 2 1 Buy Down Mortgage Awesomefintech Blog

F9l The5p4xawm

3 2 1 Buy Down Mortgage Awesomefintech Blog

![]()

3 2 1 Buy Down Mortgage Awesomefintech Blog

Case Studies Book On Entrepreneurship And Innovation Business Creation And Management By Agencia Canaria De Investigacion Innovacion Y Sociedad De La Informacion Aciisi Issuu

3 2 1 Buy Down Mortgage Awesomefintech Blog

Nicole Faulk Gmfs Mortgage Baton Rouge Louisiana

Krno Oe2shomim

Temporary Subsidy Buydown Mortgages Marimark Mortgage

What Is A 2 1 Buydown Crosscountry Mortgage